Buying your first home is an exciting milestone. At Sonawane Group, we understand the importance of making this experience smooth and successful. In this guide, we’ll walk you through 10 essential tips to help you confidently navigate the homebuying process. Explore our residential projects to find your dream home.

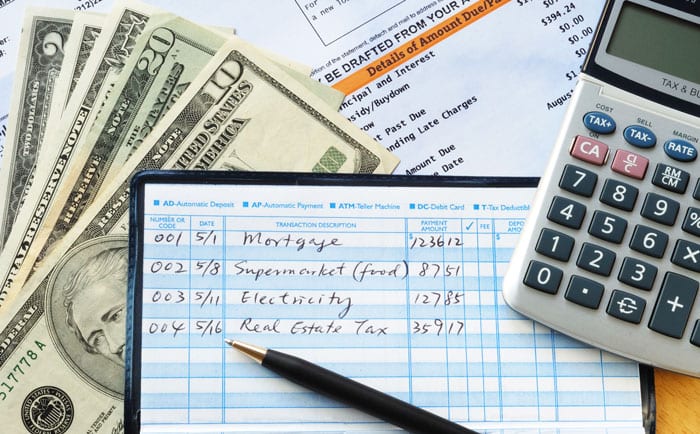

Before starting your home search, it's essential to set a realistic budget. Consider your income, savings, and monthly expenses to figure out how much you can afford. You may also explore joint loans or developer payment schemes to maximize your purchasing power.

Getting pre-approved for a mortgage shows sellers that you're serious about buying. It also gives you a clear understanding of how much you can borrow. Compare different mortgage rates and terms to find the best deal that suits your financial situation.

Make a list of your essential requirements, such as the number of bedrooms, bathrooms, or proximity to work or schools. Distinguish between must-haves and nice-to-haves to help streamline your home search. Check out our latest residential projects that cater to various needs.

Explore different neighborhoods to find one that fits your lifestyle. Look for important factors like nearby schools, transportation, and amenities. Spend time in the area at different times of day to get a feel for the community.

Choosing the right real estate agent can make all the difference. Look for someone experienced in working with first-time homebuyers. They can help you navigate the market, negotiate on your behalf, and provide valuable advice.

Take advantage of open houses and property exhibitions to view potential homes. Pay attention to the layout, natural light, and overall condition of the property. Ask questions to the agent and explore options for renovation if needed.

When reviewing contracts, be sure to read the fine print. Pay attention to property disclosures, HOA rules, and any contingencies. If you’re uncertain, seek legal advice before signing to avoid any unpleasant surprises.

Consider the long-term costs of homeownership beyond the purchase price, such as property taxes, insurance, utilities, and repairs. Being financially prepared for these expenses will help ensure you can maintain your home.

Buying a home is a significant investment. Take your time to find a property that meets your needs. Don't feel pressured to rush your decision—be patient and wait for the right home to come along.

The homebuying process can take time, and it’s important to remain flexible. With persistence and patience, you’ll find the home that’s perfect for you.